Analysis on credit score

GitHub LinkWe are on the fast track to a cashless society in the world today. In a cashless era, credit cards are a great payment method. Banks do not, however, accept every credit card application. When choosing whether to approve a card application, they take into account a variety of factors, including the applicant's age, credit history, income, and ownership of the property. We can comprehend how each of these characteristics affects one in being authorised for getting a credit card using this dataset.

We are given with the credit score and their characteristics for 12.5k customers over 8 months, giving around 100k rows.Our dataset has many null values and outliers, and we must reformat certain categorical attributes for analysis. In this project we explore how can one maintain a good credit score, and what mistakes impact a credit score.

Understanding the data

Majority of Credit Scores are in the standard segment whereas there are less than 20% customers having a good credit score. The next step was to clean data - check for unexpected values in the column. For example credit history age which had time-periods mentioned as ‘5 year and 6 months’ that needed to be changed to numeric columns as 5.5.

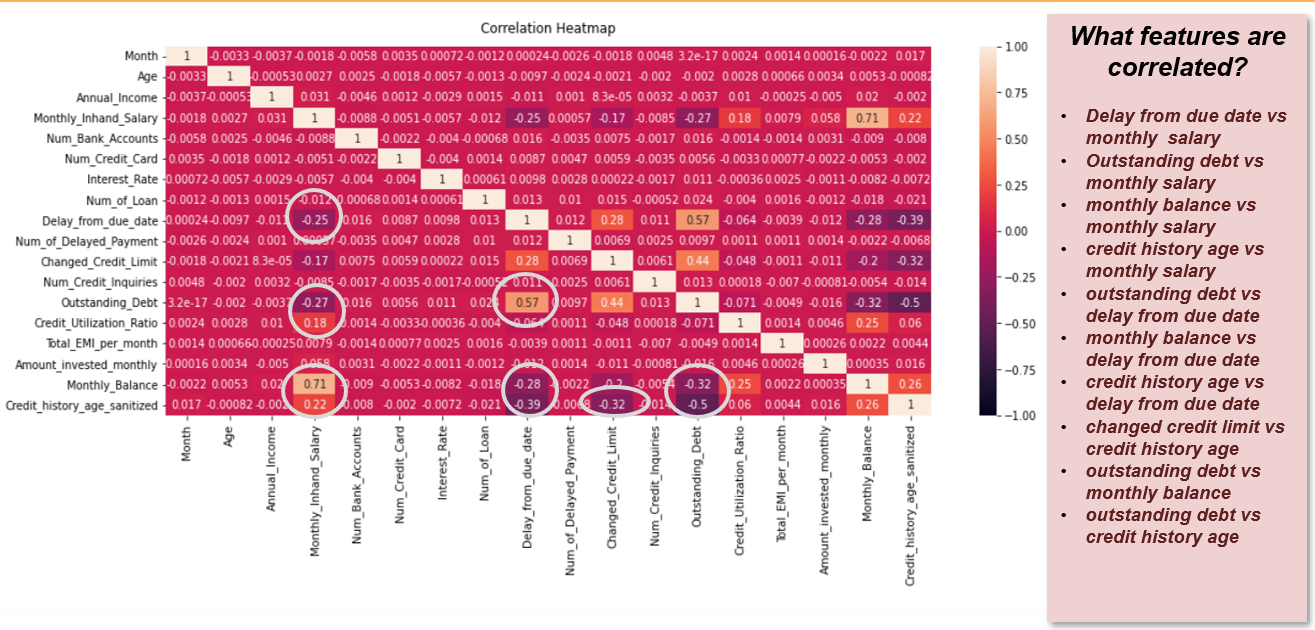

Handled null values, removed outliers and observed the following trends:

Trends in Data

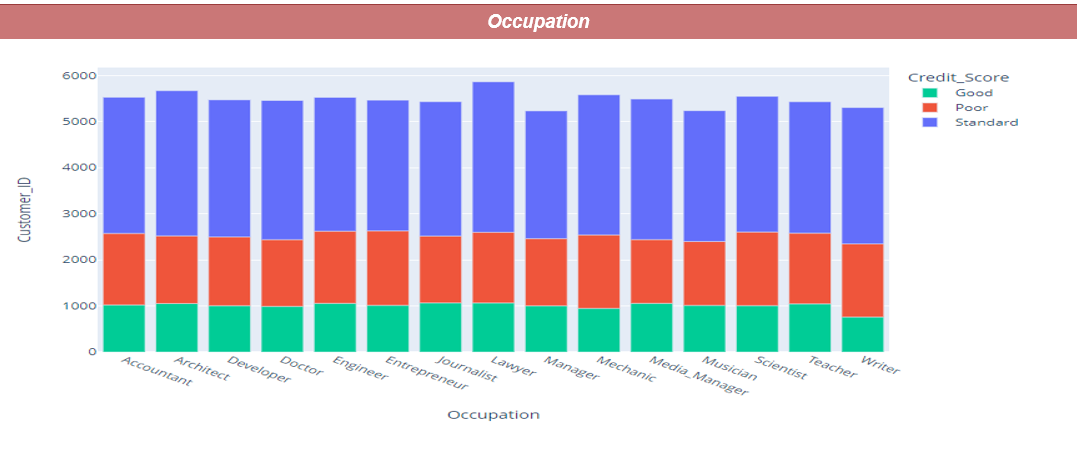

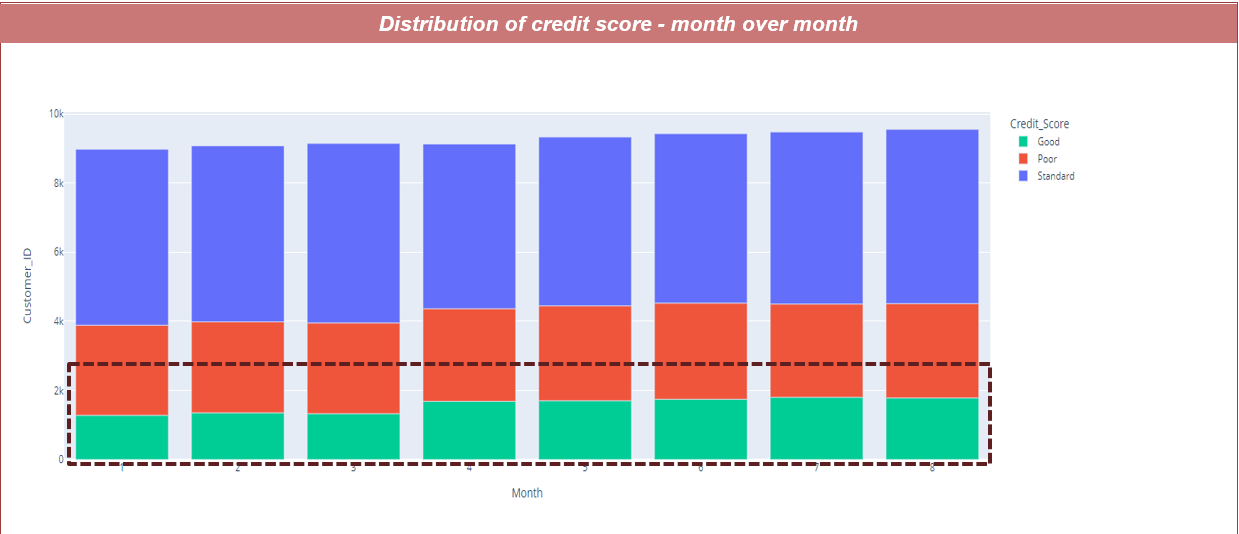

• Credit scores are almost equally distributed among all. So, it indicates that your credit score doesn’t depend significantly on your profession  • Number of customers with good credit score tend to increase slightly month over month

• Number of customers with good credit score tend to increase slightly month over month

Factors affecting credit score

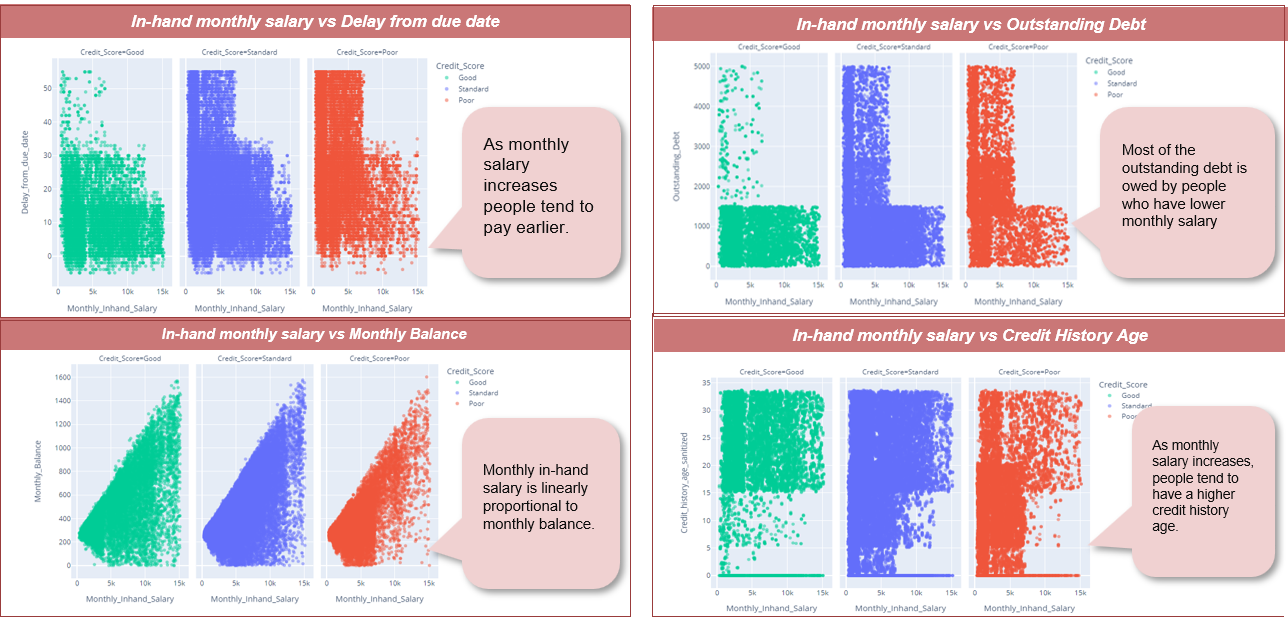

Effect of in-hand monthly salary

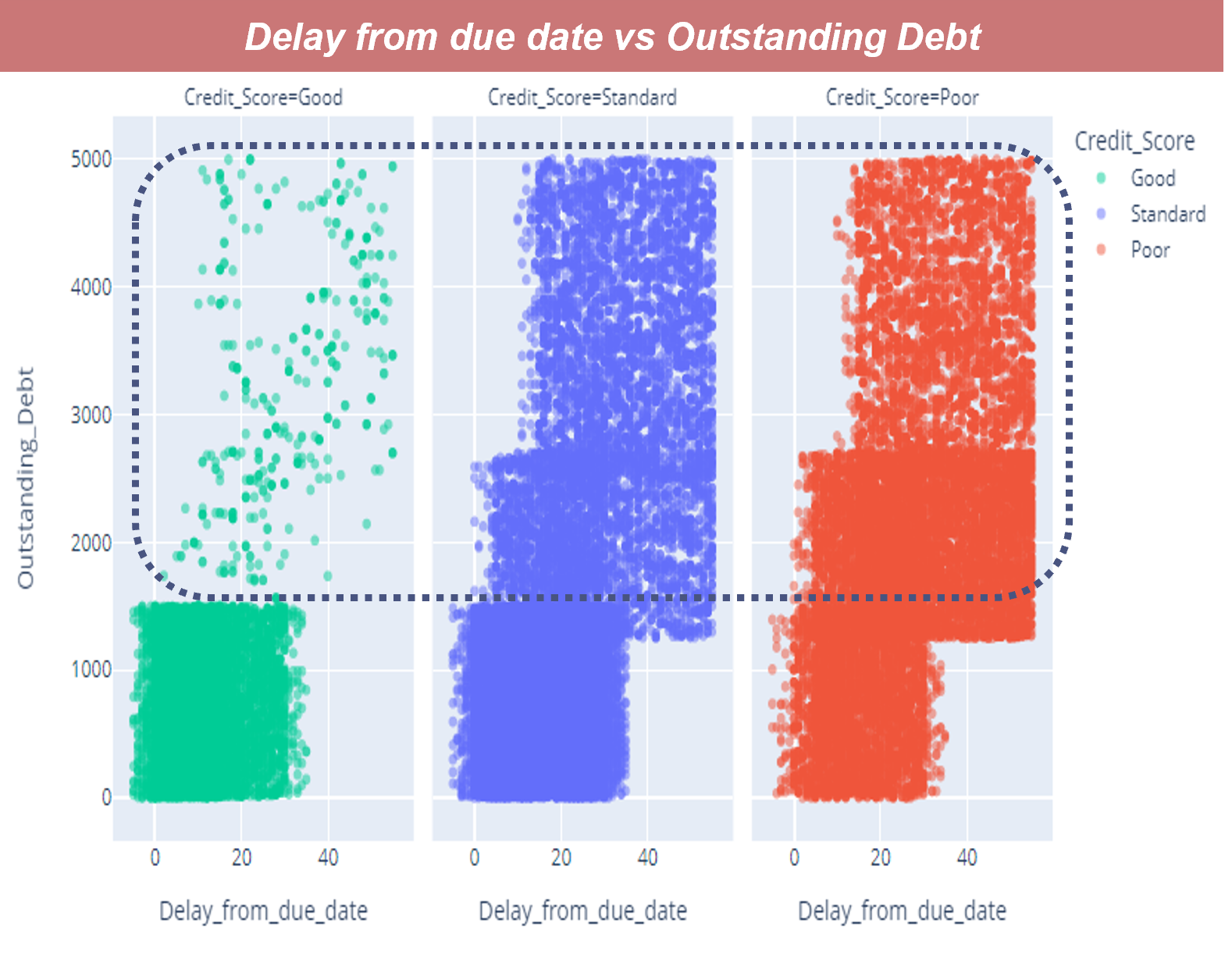

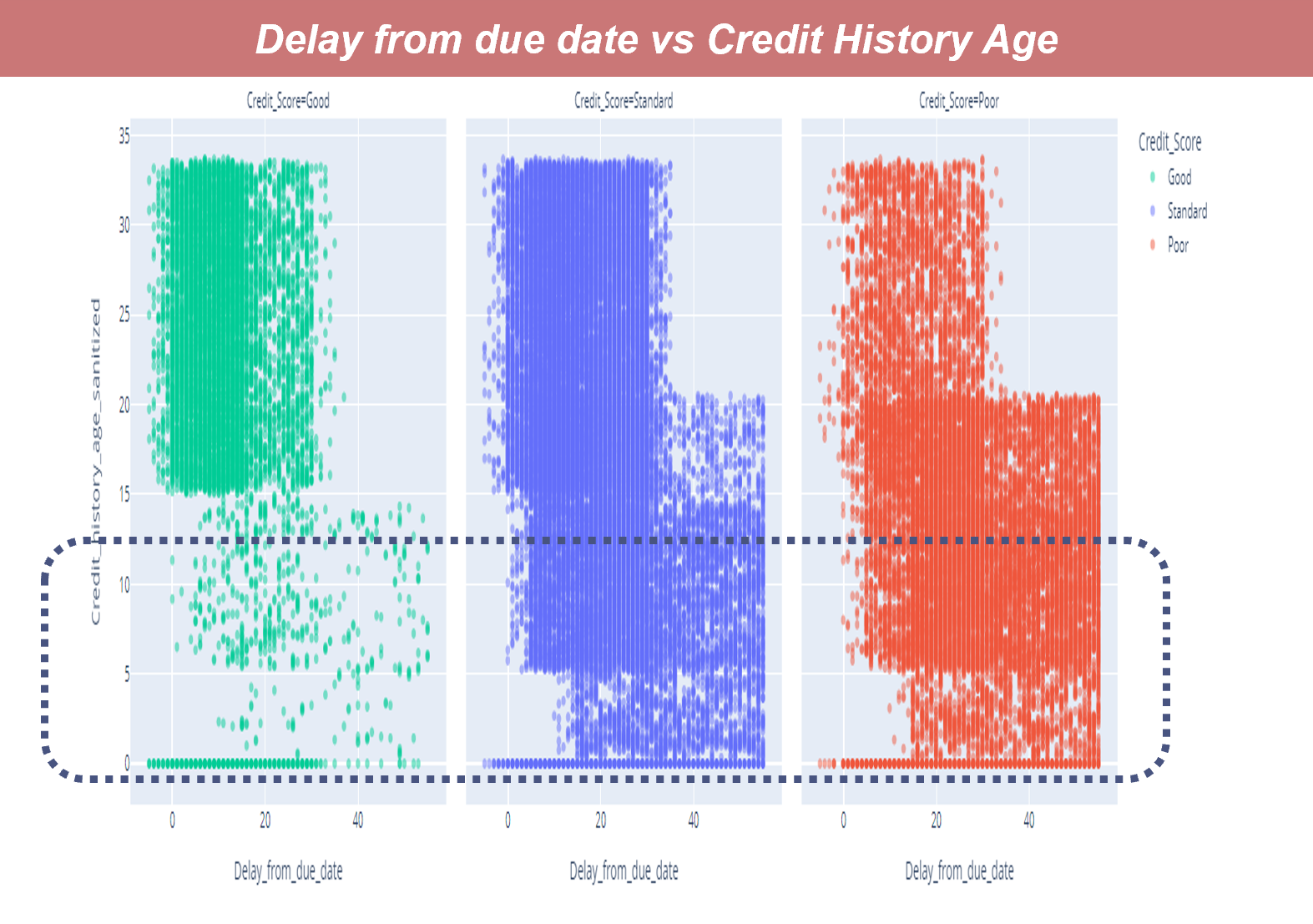

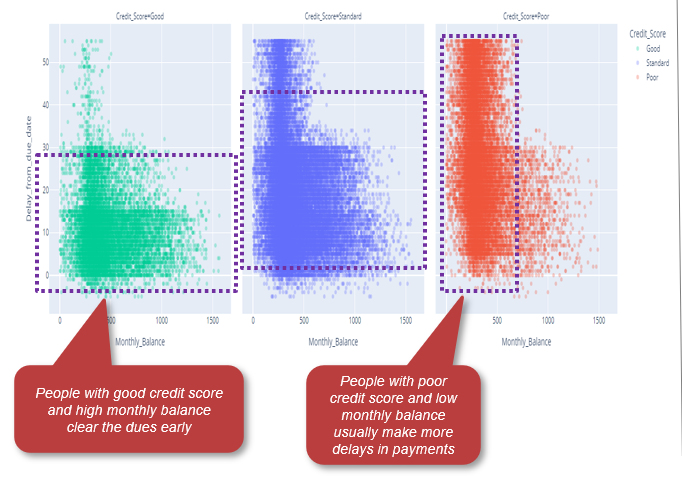

Effect of delaying payment from due date

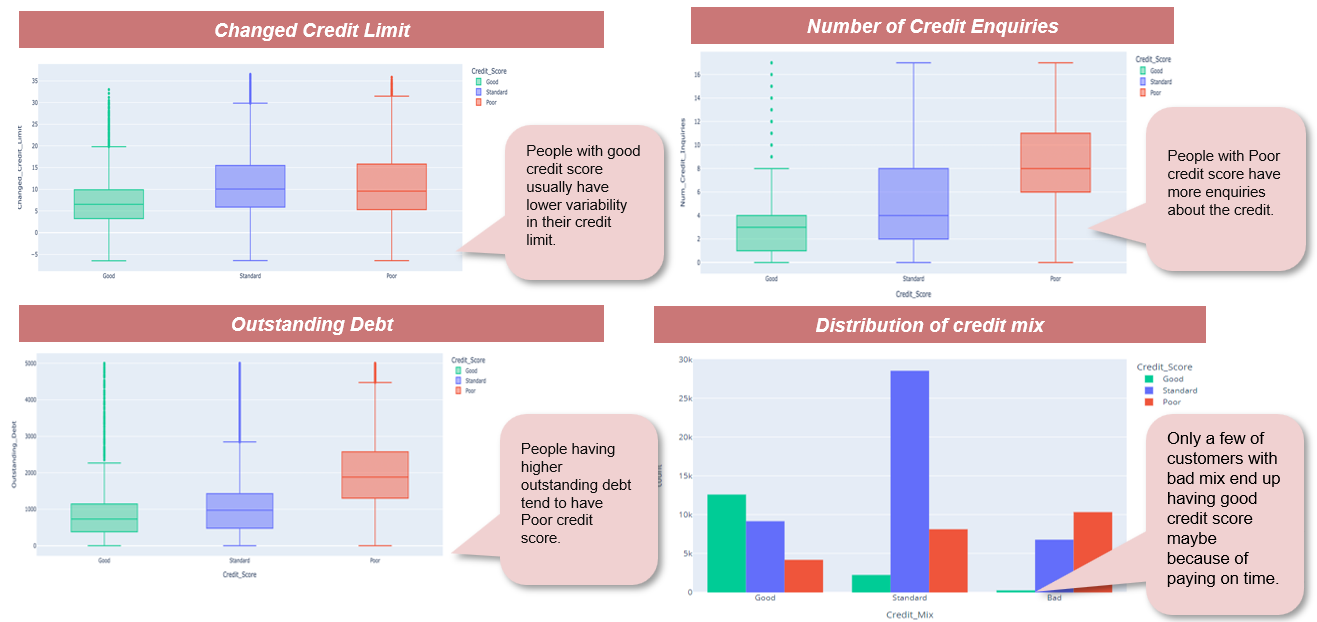

• As the payment is delayed from the due date, outstanding debt increases. • People with good credit score and high outstanding debt clear the dues early.

• Credit History Age decreases with increase in payment delay

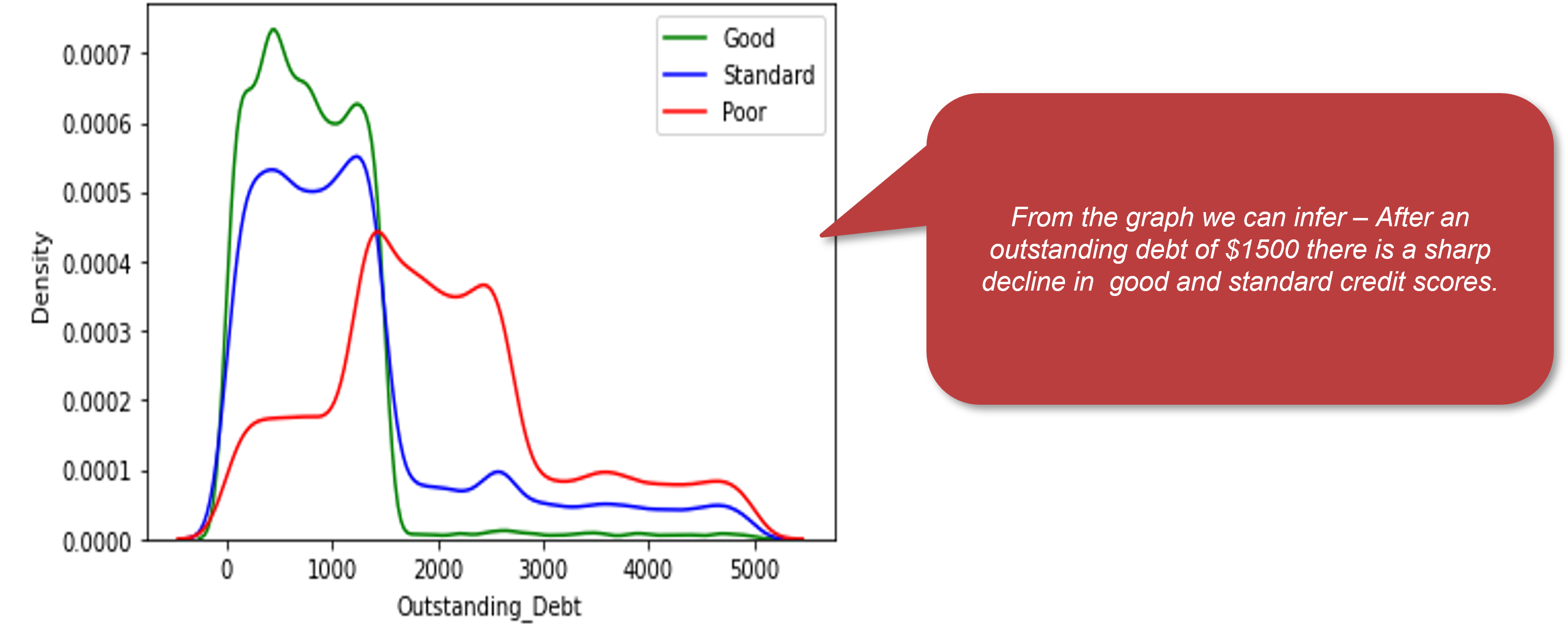

Effect of Outstanding Debt

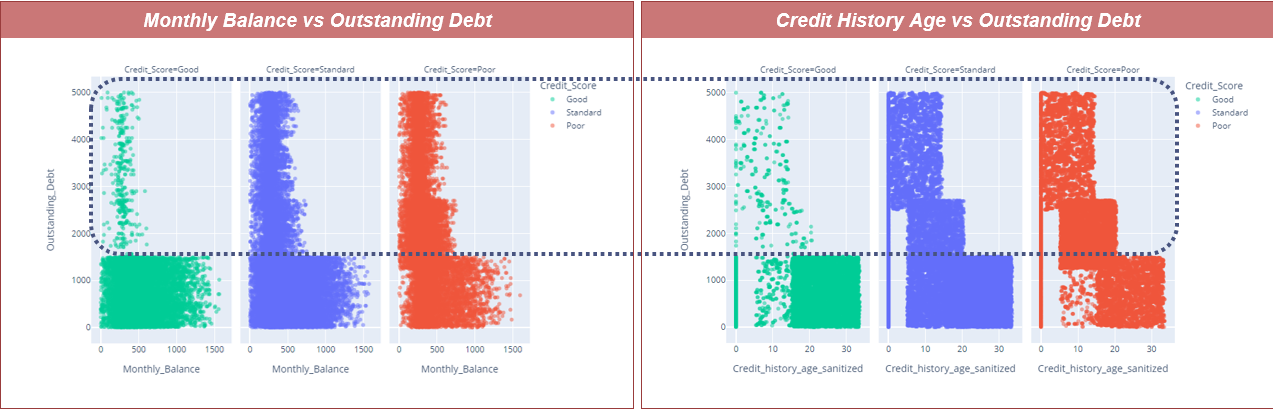

• Customers in good credit score bucket, usually end up having lower outstanding debts and their monthly account balance is decently split between 0 to 1500 dollars • Customers in the poor credit score bucket has high outstanding debts and have low monthly income • Customers who have a longer credit history end up being good customers and they usually have less outstanding debts

Recommendations

• Maintain a high account balance and avoid delayed payments

• Maintain less than $ 1,500 outstanding debts to secure a good spot in good and standard credit score bucket

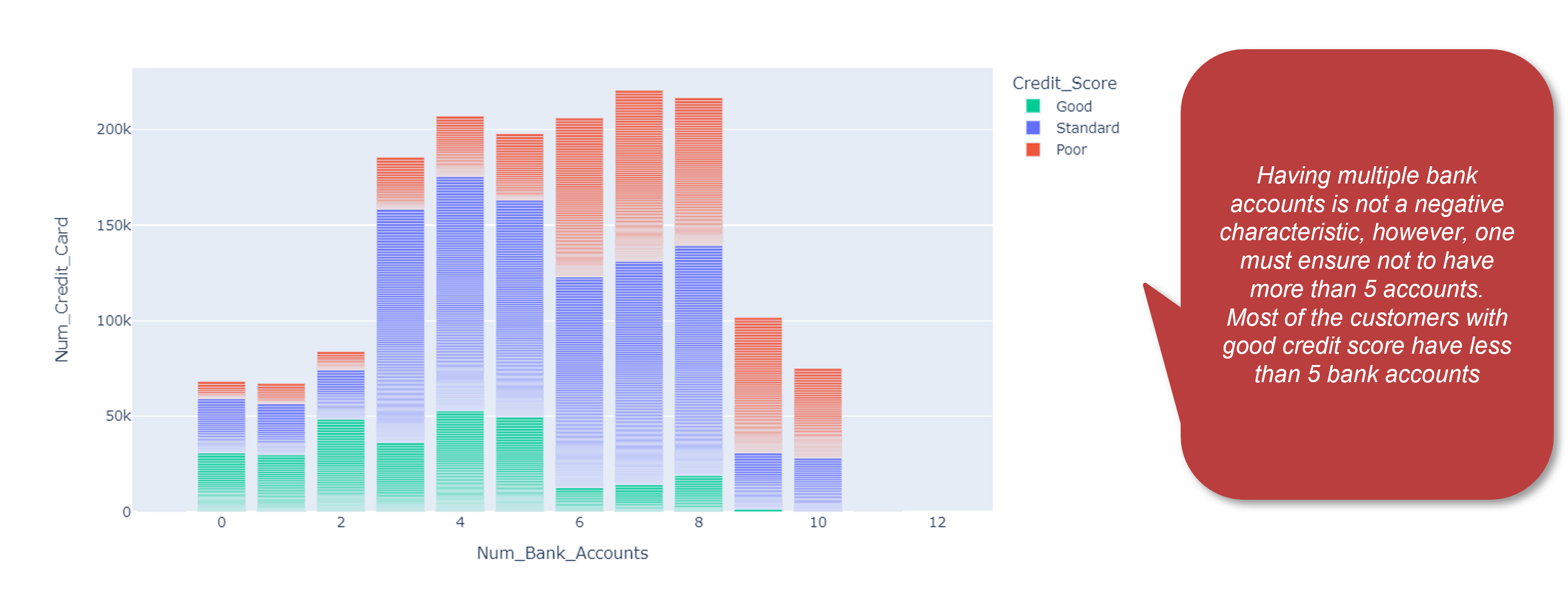

• Avoid having multiple bank accounts.

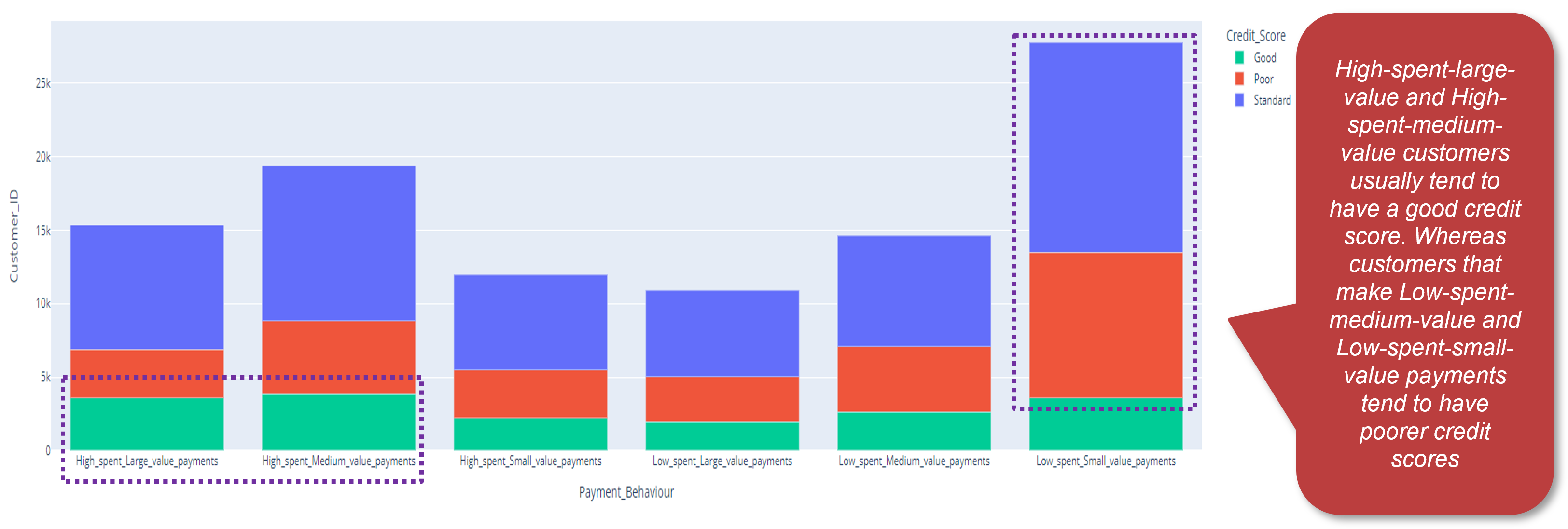

• Prioritize increasing the number of spends with large or medium dollar values and avoid payments with low small dollar values